Xinyi Solar Announces 2024 lnterim Results-Enhanced Economies of Scale, Optimised Cost Control, Product Differentiation and Innovation to Fortify Competitive Edge

Net Profit Rises 41.0% to HK$1,962.5 Million

Enhanced Economies of Scale, Optimised Cost Control, Product Differentiation and Innovation to Fortify Competitive Edge

Highlights

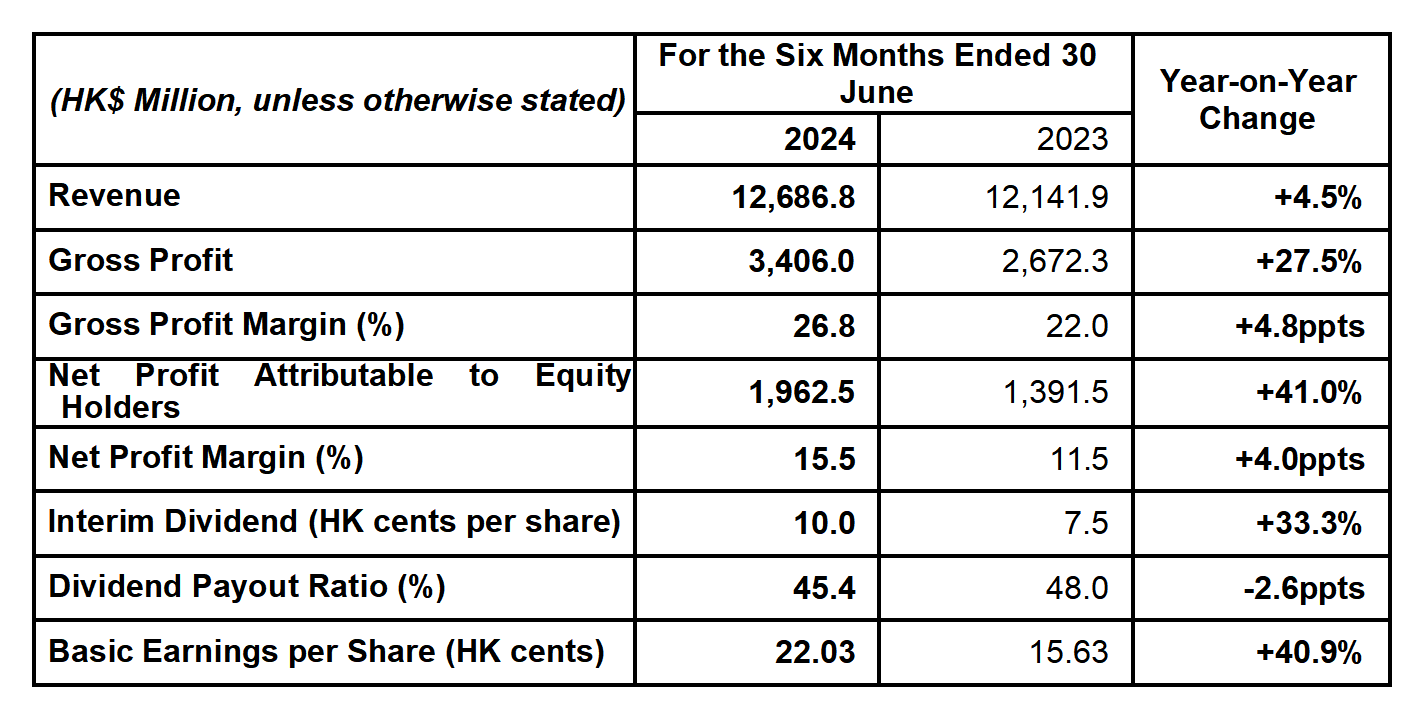

In 1H2024, the Group's consolidated revenue increased 4.5% year-on-year ("YoY") to HK$12,686.8 million. Gross profit rose by 27.5% to HK$3,406.0 million, with gross profit margin improving to 26.8% from 22.0% in 1H2023. Meanwhile, profit attributable to equity holders of the Company increased substantially by 41.0% to HK$1,962.5 million.

As of 30 June 2024, the Group maintained a healthy financial position, with cash and bank balances at HK$2,355.8 million (31 December 2023: HK$3,877.0 million). The Board of Directors has declared an interim dividend of 10.0 HK cents per share (1H2023: 7.5 HK cents). The dividend payout ratio for 1H2024 was 45.4% (1H2023: 48.0%).

Business Review

Solar Glass Business –

GP Margin Expands on Lower Procurement Costs and Efficiency Improvement

Continuous Capacity Expansion to Enhance Economies of Scale and Operational Synergies

The gross profit margin of the solar glass business increased by 6.3 percentage points to 21.5% (1H2023: 15.2%), primarily due to (i) lower procurement costs for certain raw materials and energy such as soda ash and natural gas and (ii) efficiency improvements from new capacity ramp-up, streamlined operations and optimised cost control.

To further enhance economies of scale and operational synergies, the Group will continue to expand its production capacity and upgrading its production facilities by adding new solar glass production lines in its production sites in China and overseas. As of 30 June 2024, the total melting capacity of the Group’s solar glass production lines reached 29,000 tonnes/day, of which 27,000 tonnes/day were in operation and 2,000 tonnes/day were under cold repair. The total daily melting capacity in operation increased by 4.7% and 23.9% compared to 31 December 2023 and 30 June 2023, respectively.

Solar Farm Business –

Achieves Steady Growth as Grid-connected Capacity Continues to Increase

Regarding the solar farm business, the Group completed the grid connection of two utility-scale ground-mounted solar farm projects with an aggregate capacity of 300 megawatts (“MW”) in 1H2024.

Revenue from the solar farm segment increased steadily by 3.8% YoY to HK$1,548.0 million, mainly attributable to the capacity added in the 2H2023, partially offset by the YoY depreciation of RMB against HK$.

.

Meanwhile, the Group completed the disposal of a solar farm project with capacity of 200MW to its non-wholly owned subsidiary Xinyi Energy Holdings Limited (“Xinyi Energy”) in 1H2024.

As of 30 June 2024, the cumulative approved grid-connected capacity of the Group’s solar farm projects was 6,244MW, of which 5,841MW was for utility-scale ground-mounted projects and 403MW was for distributed generation projects generating electricity for the Group’s own consumption or sale to the grid. In terms of ownership, solar farm projects with a capacity of 3,895MW were held through Xinyi Energy; solar farm projects with a capacity of 2,249MW were held through other wholly-owned subsidiaries of the Company. A solar farm project with a capacity of 100MW was held by an entity owned as to 50% by the Group.

Prospects

In the short term, the solar glass industry continues to face volatility caused by supply-demand imbalance in the solar value chain, increased competition and the industry consolidation. The business environment in which the Group operates may become more uncertain and challenging in the 2H2024. Despite the short-term headwinds, with the continued growth in downstream PV installation demand and the gradual slowdown in industry supply, the solar glass industry is poised to achieve a more stable and healthy growth, which will be beneficial to the steady and high-quality development of the industry in the long run.In order to sustain further growth and consolidate its leading market position, the Group will continue to expand its solar glass production capacity in an orderly and flexible manner and make appropriate adjustments with reference to the growth in the global PV installations and the latest market development. The Group maintains its 2024 expansion plan by adding six new solar glass production lines with an aggregate daily melting capacity of 6,400 tonnes, thereby increasing its total daily melting capacity from 25,800 tonnes as of the end of 2023 to 32,200 tonnes as of the end of 2024. In view of the uncertainties in the current market situation, the Group may adjust the targeted completion timelines for its new production lines and may flexibly advance the cold-repairing of some production lines approaching the overhaul deadlines so as to further improve the overall operational efficiency and competitiveness of the Group. Taking into account the tightening of control policies on solar glass production capacity, energy consumption and emission standards in the PRC, the Group will proactively expand its overseas production capacity and further diversify its production capacity to better meet the demand from different regions of the world.

For the solar farm business, the Group expects that the development of new solar farm projects in the 2H2024 may still be hindered by land availability, grid connection issues, increased mandatory energy storage requirements and changes in the tariff policies. Therefore, apart from the 300MW of solar farm projects already connected to the grid in 1H2024, the Group has no present plan to commission any new solar farms for grid connection in the remaining period of 2024.

Dr. LEE Yin Yee, S.B.S., Chairman of Xinyi Solar, concluded, "Despite the current challenges in the PV industry in China, we are confident on the long-term growth of the solar industry and the business growth of Xinyi Solar. The global green energy transition will continue to stimulate the widespread use of solar energy and create new demand for solar glass. In face of the cyclical adjustments of the industry, the Group will maintain a prudent approach in managing its businesses with a strong focus on managing the financial risks and the control of cost and capital expenditure. Our strong customer base, economies of scale, continuous production innovation and technological improvements will enable us to remain competitive amidst the increased competition and rapidly changing market conditions. As an industry leader, the Group will leverage its scale advantage, further strengthen its operations and management, and strive for a sustainable and high-quality development of its solar glass and solar farm businesses."